Millions of Americans on Social Security will see less money than expected in 2026. Medicare Part B premiums are going up by $17.90 per month, and that increase will be deducted directly from benefit checks.

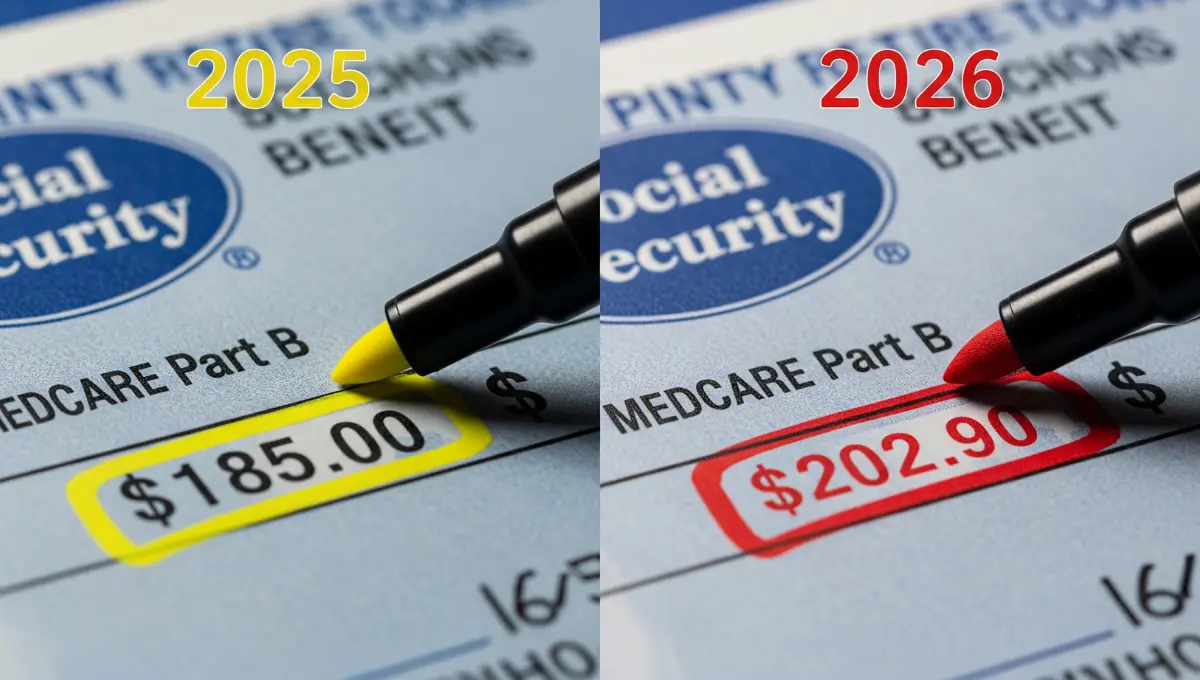

The Centers for Medicare & Medicaid Services (CMS) announced that the standard Medicare Part B premium will rise to $202.90 per month in 2026. That’s up from $185.00 in 2025—a 9.7% jump in just one year.

For seniors who rely on Social Security, this means a smaller raise than it looks on paper.

Social Security recipients will receive a 2.8% Cost-of-Living Adjustment (COLA) in 2026. For the average retiree, that’s about $56 more per month, bringing the typical check to roughly $2,071.

But after Medicare takes its cut, the real gain shrinks fast.

The $17.90 premium increase will absorb nearly 32% of the average COLA boost. That leaves most retirees with a net increase of only $38 per month after the Part B deduction.

“It feels like we’re taking one step forward and two steps back,” said one Social Security advocate speaking to local news. “People were counting on that raise.”

CMS says the premium hike is tied to higher projected spending on outpatient services and specialty medical products. As healthcare costs continue to climb, so do the expenses passed on to beneficiaries.

There is some protection in place. A federal rule called the “hold-harmless” provision prevents Medicare premiums from increasing more than a person’s Social Security COLA. That means for most people, their net monthly payment will not go down compared to 2025.

But it also means the promised raise won’t go very far.

Medicare Part B covers doctor visits, outpatient care, and medical equipment. Most people on Social Security have the premium deducted automatically each month. It’s one of the biggest out-of-pocket costs for retirees.

In addition to the monthly premium increase, the annual Part B deductible is rising to $283 in 2026, up $26 from $257 in 2025. That’s another cost seniors will have to meet before Medicare starts covering services.

Higher earners will pay even more. Beneficiaries with incomes above $109,000 for individuals or $218,000 for joint filers will be subject to an Income-Related Monthly Adjustment Amount, or IRMAA. These surcharges are based on 2024 tax returns.

For example, someone who earned between $109,001 and $137,000 in 2024 will pay a total monthly premium of $284.10 in 2026. At the top end, those earning $500,000 or more individually will pay $689.90 per month.

The Social Security Administration (SSA) will send new benefit statements in December showing exact amounts after the Medicare deduction.

Other Medicare costs are also climbing. The Part A deductible will rise to $1,736 per benefit period, an increase of $60. For the small number of people who pay a premium for Part A, the cost jumps to $565 per month in 2026.

There is one piece of good news. A new $2,100 annual cap on out-of-pocket prescription drug costs under Medicare Part D takes effect in 2026. That change could save money for people with expensive medications.

But for now, many retirees are bracing for tighter budgets. With inflation still high and medical costs rising, the 2026 COLA won’t stretch as far as hoped.

The SSA and CMS both recommend reviewing Medicare coverage during open enrollment to ensure beneficiaries are getting the best value. Open enrollment for 2026 ended in December, but changes can still be made under certain circumstances.

For questions about Social Security or Medicare, beneficiaries can visit ssa.gov or medicare.gov, or call 1-800-MEDICARE for assistance.