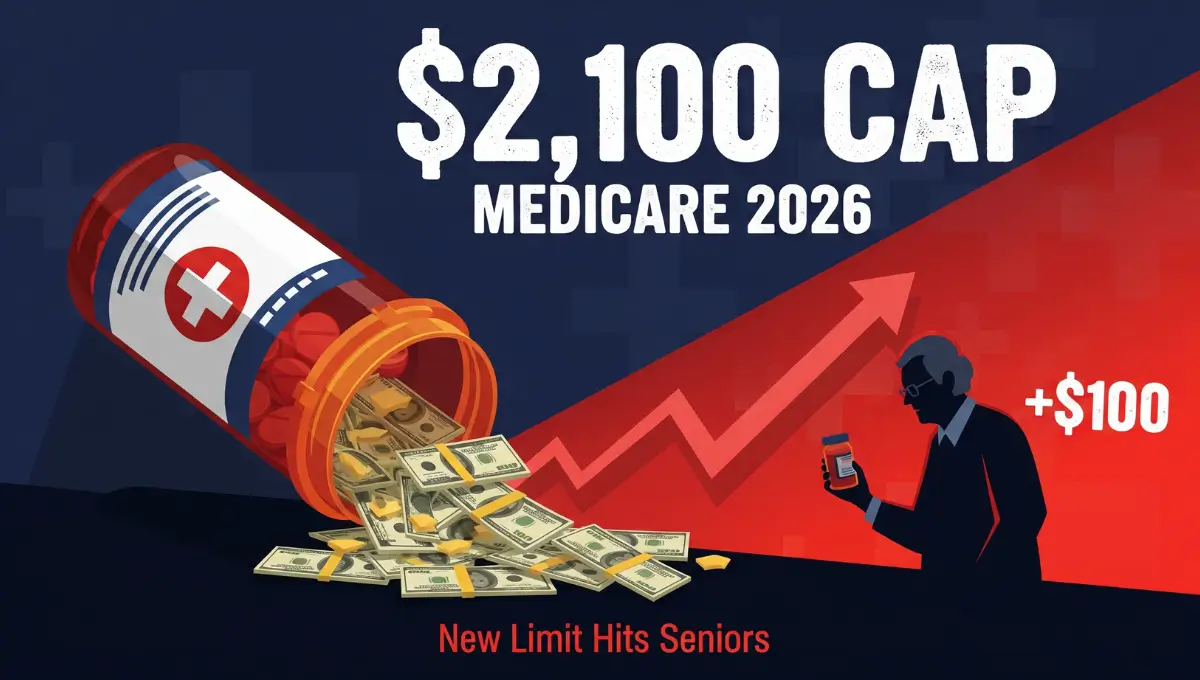

Medicare beneficiaries will face a new reality in 2026. The out-of-pocket maximum for prescription drugs under Medicare Part D has increased to $2,100, up from $2,000 in 2025.

The increase is tied to pharmaceutical inflation. Federal law allows the cap to adjust each year based on rising drug prices.

For many seniors on fixed incomes, the extra $100 could mean tougher choices at the pharmacy.

Once you spend $2,100 out of pocket on covered drugs, your plan pays 100% of costs for the rest of the year. You pay nothing after hitting that limit. This is called catastrophic coverage.

Read More: Medicare Part B Premiums Rise in 2026

But not everything counts toward that cap.

What counts:

- Your annual deductible, which can be as high as $615 in 2026

- Copayments and coinsurance for covered prescriptions

- All out-of-pocket spending on drugs listed in your plan’s formulary

What does not count:

- Monthly Part D premiums

- Costs for drugs not covered by your plan

- Spending on medications covered under Medicare Part B, not Part D

The Centers for Medicare & Medicaid Services (CMS) confirmed these updates in late 2025. Officials said the cap still offers strong financial protection compared to previous years when there was no hard limit.

New tools are available to help manage costs in 2026.

The Medicare Prescription Payment Plan lets enrollees spread their drug costs into monthly payments instead of paying large sums upfront at the pharmacy. This option is automatic for all Part D and Medicare Advantage members.

Insulin users get extra relief. A 30-day supply of covered insulin is capped at $35 or less, with no deductible required. That protection continues in 2026.

Medicare also negotiated lower prices on 10 high-cost medications for the first time. Drugs like Eliquis, Jardiance, and Januvia now cost less. Patients taking these medications could see significant out-of-pocket savings this year.

The $2,100 cap applies to all Medicare beneficiaries with prescription drug coverage. That includes standalone Part D plans and Medicare Advantage plans with drug benefits.

Seniors should review their plan options during open enrollment. Drug lists and costs can vary widely between plans.

Financial experts recommend checking whether your current medications are still covered and comparing total expected costs, not just premiums.

The Social Security Administration and CMS both urge beneficiaries to use Medicare.gov or call 1-800-MEDICARE for personalized help.

While the cap offers protection, the $100 increase signals ongoing pressure from rising pharmaceutical costs. Advocates say more action is needed to control drug pricing at the source.

For now, millions of Medicare users will need to budget slightly more in 2026—even as new safeguards take effect.