Last Updated by Akash Biswas: January, 2026

Veterans with service-connected disabilities receive monthly tax-free compensation from the VA.

Rates for 2026 increased 2.8% due to the annual Cost-of-Living Adjustment (COLA), effective December 1, 2025.

Quick Summary:

- 2026 VA disability pay increased 2.8% starting December 1, 2025

- Monthly payments range from $180.42 (10%) to $3,938.58 (100%)

- Veterans rated 30% or higher qualify for dependent compensation

- Special Monthly Compensation (SMC) provides extra pay for severe disabilities

- All VA disability payments are tax-free

- First 2026 payment issued December 31, 2025

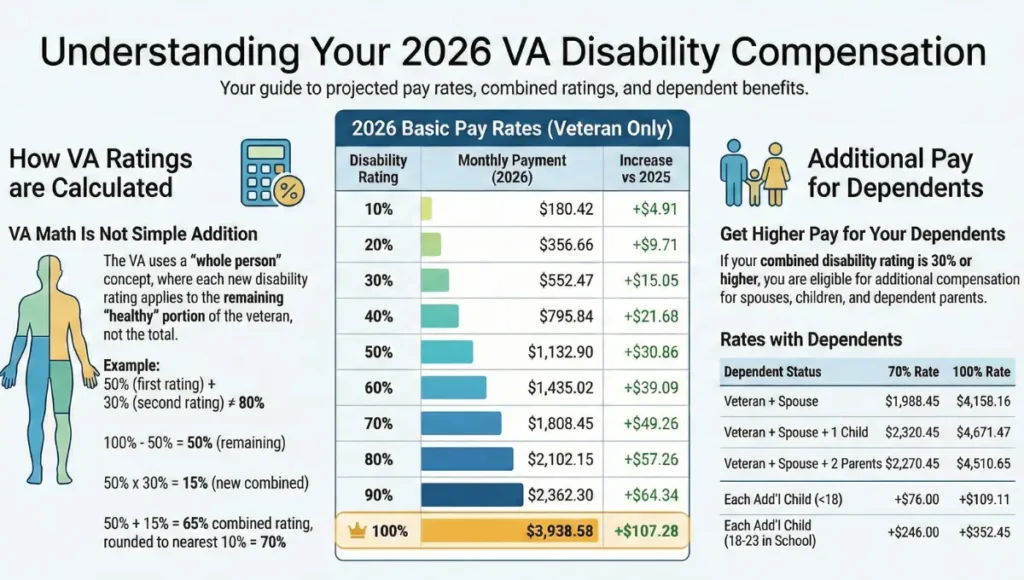

Basic VA Disability Pay Rates 2026

Veterans without dependents receive these monthly amounts based on their disability rating:

| Disability Rating | Monthly Payment | Increase vs 2025 |

|---|---|---|

| 10% | $180.42 | +$4.91 |

| 20% | $356.66 | +$9.71 |

| 30% | $552.47 | +$15.05 |

| 40% | $795.84 | +$21.68 |

| 50% | $1,132.90 | +$30.86 |

| 60% | $1,435.02 | +$39.09 |

| 70% | $1,808.45 | +$49.26 |

| 80% | $2,102.15 | +$57.26 |

| 90% | $2,362.30 | +$64.34 |

| 100% | $3,938.58 | +$107.28 |

Source: VA.gov

VA Disability Rates With Dependents

Veterans rated 30% or higher receive additional monthly compensation for qualifying dependents. This includes spouses, children under 18, students under 23, and dependent parents.

Most Common Dependent Rates (70% and 100%)

| Dependent Status | 70% Rate | 100% Rate |

|---|---|---|

| Veteran + Spouse | $1,961.62 | $4,158.17 |

| Veteran + Spouse + 1 Child | $2,074.70 | $4,318.99 |

| Veteran + Spouse + 2 Parents | $2,208.34 | $4,510.65 |

| Each Additional Child (Under 18) | +$76.00 | +$109.11 |

| Each School Child (Ages 18-23) | +$246.00 | +$352.45 |

Additional Rates for 30%-60%

Veterans with lower ratings also qualify for dependent compensation:

- 30% with spouse: $618.26/month

- 40% with spouse: $883.22/month

- 50% with spouse: $1,241.87/month

- 60% with spouse: $1,566.60/month

Source: VA.gov

How VA Disability Ratings Work

The VA uses a “combined rating” system. Multiple disabilities don’t add up directly.

Example:

50% rating + 30% rating ≠ 80%

The VA applies the 30% to your remaining 50% “health,” resulting in 65% (rounded to 70%).

Veterans qualify with service-connected disabilities rated 10%-100%. The VA evaluates medical records, service records, and examinations to assign ratings.

Special Monthly Compensation (SMC)

SMC provides extra pay for severe disabilities beyond standard compensation.

Common SMC Types:

- SMC-K (Loss of Use): $139.87/month

For loss of a hand, foot, or other body part - SMC-L (Aid & Attendance): $4,900.83/month

For veterans needing daily care assistance - SMC-M (Severe Loss): $5,408.55/month

For loss of two extremities or blindness with deafness

SMC adds to your base disability pay.

Source: VA.gov

2026 COLA Increase Explained

The 2.8% COLA increase matches Social Security adjustments. It’s based on inflation measured from July-September 2025.

Recent COLA History:

- 2023: 8.7% (largest increase in decades)

- 2024: 3.2%

- 2025: 2.5%

- 2026: 2.8%

This adjustment applies automatically. Veterans don’t need to apply.

2026 VA Payment Schedule

Key Dates:

- December 1, 2025: New 2.8% rates take effect

- December 31, 2025: First payment with 2026 rates (covers December)

- February 1, 2026: Regular schedule resumes (payments on first business day)

VA pays monthly on the first business day. If the first falls on a weekend or holiday, payment arrives the prior business day.

Check payment status at VA.gov or through eBenefits.

Who Qualifies for VA Disability Pay

Eligibility Requirements:

- Service-connected disability rated 10%-100%

- Honorable or general discharge

- Medical evidence linking disability to military service

Dependent Requirements (30%+ rating):

- Spouse must be legally married to veteran

- Children must be under 18 (or under 23 if enrolled in school)

- Parents must receive 50%+ financial support from veteran

Veterans can file claims at VA.gov.

Additional VA Benefits at 100%

Veterans rated 100% receive extra benefits:

- Free VA healthcare (Priority Group 1)

- Commissary and exchange access

- Education benefits for dependents

- State-specific perks (property tax exemptions, license plates)

Total Disability Individual Unemployability (TDIU) allows some veterans to receive 100% pay even with lower ratings if unable to work.

How to Apply or Increase Your Rating

New Claims:

File online at VA.gov or work with a Veterans Service Officer (VSO).

Increase Requests:

Submit evidence if your condition worsened. Use VA Form 21-526EZ.

Appeals:

If denied, request a Higher-Level Review, Supplemental Claim, or Board Appeal within one year.

Free help is available through VA-accredited representatives and VSOs.

FAQs: VA Disability Pay 2026

1. When did the 2026 VA disability pay increase take effect?

The 2.8% increase took effect December 1, 2025, with first payments issued December 31, 2025.

2. Are VA disability payments taxable?

No. All VA disability compensation is tax-free at federal and most state levels.

3. Can I receive VA disability and Social Security at the same time?

Yes. VA disability doesn’t reduce Social Security benefits. Both are independent programs.

4. How is my combined VA disability rating calculated?

The VA uses a “whole person” formula, not simple addition. A 50% and 30% rating combine to 65%, rounded to 70%.

5. Do I get extra pay if my spouse needs assistance?

Yes. Aid and Attendance add-ons range from $59.62 to $201.41 monthly, depending on your rating (30%-100%).

6. What if my disability gets worse after my rating?

File for an increase using VA Form 21-526EZ. Provide new medical evidence showing the worsening condition.

Official Sources:

Note: Rates shown reflect 2026 COLA adjustments. Always verify current rates at VA.gov for the most accurate information.